Developed by the United Nations Capital Development Fund (UNCDF) – Pacific Insurance and Climate Adaptation Programme (PICAP)

What is the innovation?

The ‘Pacific Insurance and Climate Adaptation Programme is a multi-year Programme that is jointly implemented by UN Capital Development Fund (UNCDF), UN Development Programme (UNDP) and UN University- Institute for Environment and Human Security (UNU-EHS). PICAP was launched in December 2020 with the aim to build and improve the financial preparedness and resilience of Pacific Islanders against climate change and natural hazards through the development and implementation of market-based meso and micro insurance schemes.

As part of this mission, PICAP has conducted studies on the protection gap in the Pacific countries which identifies the financial vulnerabilities of households, communities, and small businesses (MSMEs) to improve their financial preparedness. This foundational work has guided the program’s efforts to design relevant CDRFI products for the region.

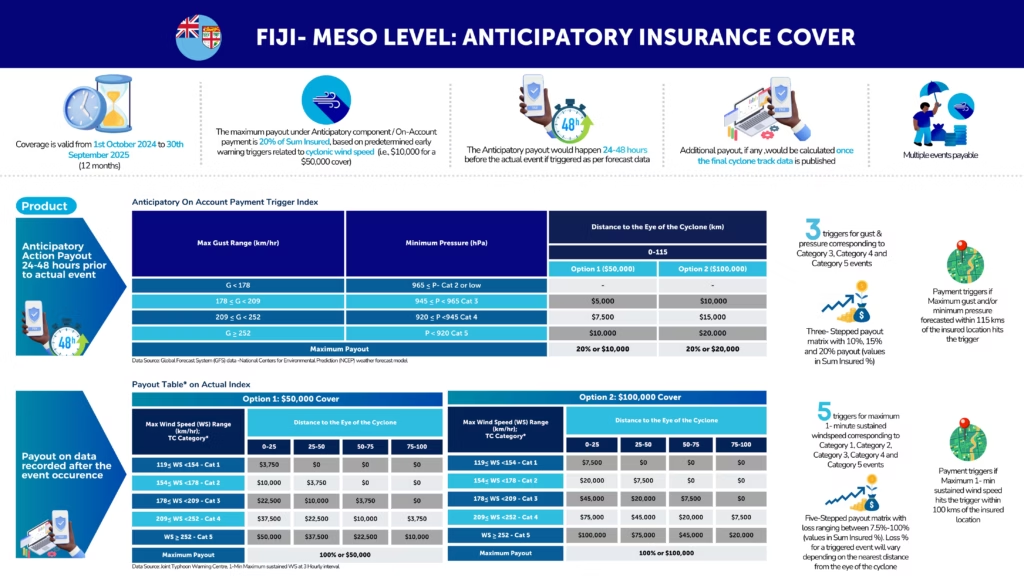

In 2021, Fiji achieved a milestone with the introduction of its first-ever parametric microinsurance product, supported by PICAP. This initiative, led by local insurers, agriculture and farming agencies, as well as mobile network operators, received support from the Pacific Insurance and Climate Adaptation Programme (PICAP). This multi-dimensional partnership helped accelerate claim payments through mobile money platforms and ensure prompt assistance to policyholders.

In the early stages, PICAP conducted ideation workshops with stakeholders, including regulatory bodies like the Reserve Bank of Fiji, to fine-tune product offerings. These workshops helped design a microinsurance product tailored to the climate vulnerabilities in the Pacific context, specifically targeting marginalized groups such as farmers, fishers, market vendors and MSMEs. By setting predefined parameters (like wind speed and rainfall levels), parametric insurance eliminates the need for on-site loss assessments, enabling faster payouts to policyholders after a trigger event, such as a cyclone or heavy rainfall.

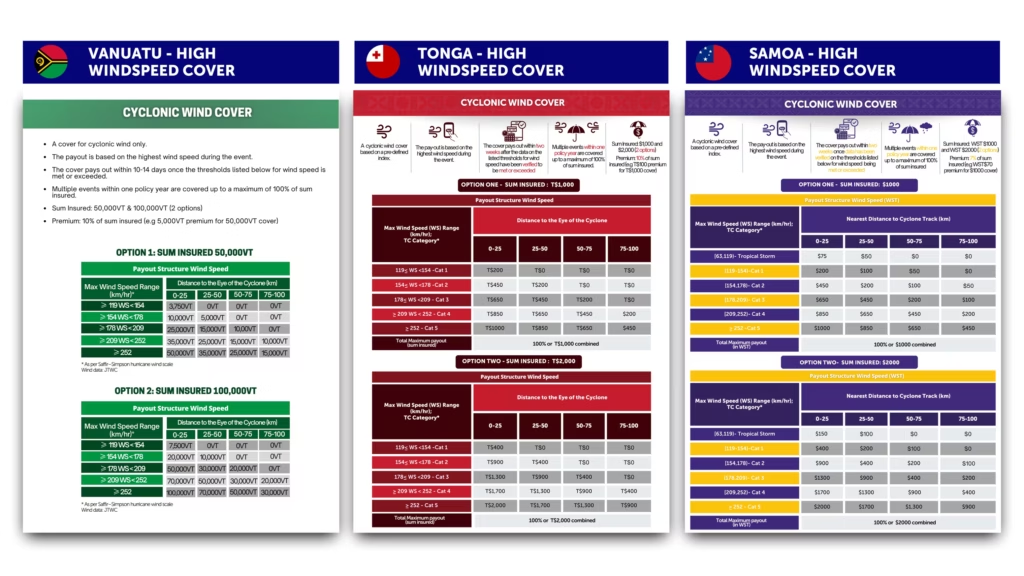

PICAP has also developed and launched parametric insurance products in; Tonga (Nov 2022), Vanuatu (Oct 2022), Samoa (Oct 2023) with Solomon Islands and Kiribati set to follow in early 2025. During the product development and roll-out stage, PICAP ensures it includes multiple stakeholders and builds their capacity for sustained business cases for insurance providers and aggregators, and value propositions for the insurance users.

Case studies

Case Study 1:

Kalesi Ledua is a full-time farmer and member of Cane Farmer’s Co-operative Savings & Loans Association (CCSLA). Having left the tourism industry as a chef, Kalesi pursued farming as a full-time career. “As a full-time farmer, now I know how the struggle is. I didn’t know it when I was working in the tourism industry as a full-time chef”. Based in Bilawaqadea, Nadi, Kalesi plants cassava, dalo, and other vegetables and fruits.

Since signing up to be covered, Kalesi has developed critical thinking skills and diversified her sources of income. She has ventured into crop diversification by planting dragon fruit, avocado, and radish. Kalesi has also recently opened a canteen. Due to the heavy rainfall experienced in January 2023, Kalesi met the conditions for a payout from the heavy rainfall cover and purchased seedlings as a further investment into her business.

Kalesi encouraged other farmers to sign up for the parametric insurance product. “Whatever farmer that we have across Viti Levu, Vanua Levu, and maritime areas, I would suggest for them to sign up”. When asked if she would renew her policy for the next cyclone period, “Yes, I will continue to purchase the product again. It has helped a lot, it’s quick assistance apart from waiting for government assistance to reach us”.

Case Study 2:

With a 10-acre farmland in Holika, Votualevu Village, Nadi, Niko Baleivarata tends to his farm with his wife and son. Niko plants cassava, yam, pineapple, bananas, and is also involved in beekeeping along with a few cattle and chickens.

Signing up for the $100 heavy rainfall cover, Niko met the trigger conditions for the heavy rainfall experienced in his farm. “Even to me, what I have received (payout) is a big help”. This further highlight how the parametric insurance cover allows farmers to adapt to the changing climate. With timely financial assistance at a crucial time, Niko plans to renew his policy, “I was really really happy, receiving that money during the rainy season, it was just a big help. My advice to the farmers, farmers join this insurance product. Your days ahead, we don’t know, maybe there’s another storm, another earthquake. You could receive something just to back you up in your time of need”.

Case Study 3:

At 65 years old, Salaseini Koroi is a sugarcane farmer, and plants cassava, ginger, and an assortment of fruit trees. Since learning about the parametric microinsurance product in 2022 through SCGC, Salaseini immediately signed up for it. “I signed up for it because it is different from life insurance, it was totally different. I was motivated to sign up because I knew being retired, and coming to an old age, we need to have money especially after a disaster. That is why it has motivated me to sign up and get on to this parametric insurance”.

Based in Buabua, Lautoka, Salaseini has continued to experience heavy rainfall which reaches knee-high on her sugarcane plantation. When asked if she would renew her policy for the next cyclone period, Salaseini stated “Yes, I have been an agent campaigning about this parametric insurance to my neighbors’, especially to women and aged farmers in Buabua. Before this parametric (payout) we hadn’t received anything. It was only during Winston that we waited for so many months until we received (assistance). This (payout) is my only assistance. I thank the parametric insurance because just when disaster happens, and we are able to handle money in our hands, it eases the problem, and it boosts us to do more, and that the parametric insurance will always be with us”.