What is the innovation?

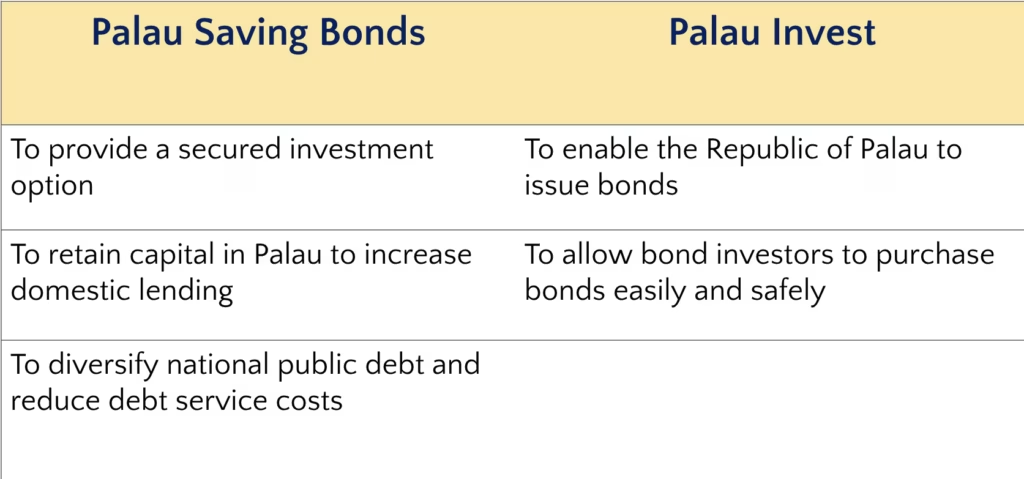

Palau Savings Bonds, as well as future bond issuances, will help the Republic of Palau raise capital for developmental lending and help investors grow their investments.

Palau Invest will become a trusted platform for bond investors, including Palauan citizens, and the Republic of Palau, offering a convenient and safe way to participate in national development.

What Palau Savings Bonds and Palau Invest bring

Keys for Successful Implementation

Palau Savings Bonds

- Prospectus approval from Congress

- Data collection and analysis

- Continuous monitoring of market conditions

- Transparent communication with bond investors

Palau Invest Platform

- Platform safety and convenience

- Public awareness

- Platform user and staff training

- Continuous feedback and improvement

Other challenges

Capacity constraints

System maintenance costs (initial cost was free)

Regulatory compliance

Solutions

Smaller initial issuance(s)

Training with Soramitsu

Fee for bond transactions

No secondary market (at this time)

Application example to Pacific Region

Palau Savings Bonds

Retail market – mostly unexplored

Close comparison: Fiji Infrastructure Bonds

Other PICs that issue bonds include Vanuatu and Tonga

Successful stories of retail bonds from neighbors, Philippines and Indonesia

Palau Invest Platform

Sale of bonds: Platforms used, if there are any, are for institutional investors rather than retail investors

Philippines: one can buy savings bonds directly online from the Bureau of the Treasury or via a mobile app (e.g. Bond.PH)

Blockchain technology: Mostly on CBDCs, including Soramitsu’s proof of concept in the Solomon Islands

Scalability and Replicability

Scalable? Yes

Future, diverse issuances are expected.

Future introduction of other payments methods, a possibility

Replicability?

Palau Savings Bonds – easy

Palau Invest Platform – Not sure with blockchain technology